The Strategic Tax Planning Blueprint: How Proactive Business Owners Reduce Lifetime Tax Liability

February 6, 2026

Many business owners don’t overpay taxes simply because they earn more. Often, higher tax costs result from planning that begins after key financial decisions have already been made. Income timing, major purchases, and compensation structures are frequently finalized before tax strategy is considered, which can limit available options once the year is underway.

Strategic tax planning for business owners helps address this challenge by taking a forward-looking approach. At RC Jones & Associates, tax planning is treated as an ongoing advisory process rather than a once-a-year task. By reviewing decisions throughout the year, business owners and high-income earners can better manage tax exposure, support consistent cash flow, and make informed financial choices before taxes are finalized.

Why Tax Compliance Alone Costs Business Owners More

Tax compliance answers one question:

“What do I owe based on what already happened?”

Strategic tax planning answers a far more valuable one:

“How do we structure decisions so less tax is owed in the future?”

Many firms focus only on filing accurate returns. While compliance is essential, it does not:

- Reduce future tax exposure

- Optimize entity structure

- Improve income timing

- Align taxes with business growth

This is why growth-minded owners move beyond compliance and seek business tax advisory services that focus on planning—not just filing.

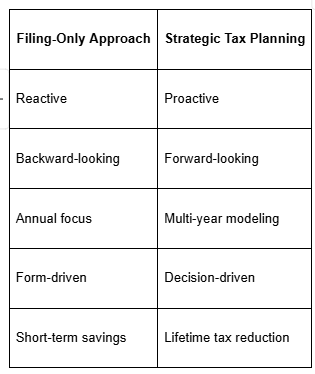

Filing Taxes vs. Designing a Tax Strategy

Taxes are not a one-year expense. They are a long-term financial cost.

Who Strategic Tax Planning Is Designed For

Strategic tax planning delivers the greatest impact for:

- Business owners earning $250,000+ annually

- S-Corporation owners

- Multi-entity businesses

- Professionals with W-2 and business income

- Investors and real estate owners

- Entrepreneurs planning growth or exit

If income is increasing and decisions feel reactive, proactive planning is no longer optional.

The 5 Pillars of Strategic Tax Planning

1️⃣ Entity Optimization: The Foundation of Tax Efficiency

Your business entity is not a permanent decision.

What worked when revenue was low can become inefficient as income grows. Strategic planning includes periodic entity structure optimization to ensure your structure still minimizes tax and supports future goals.

👉 Read more about

Entity Structure Optimization

Many business owners overpay simply because their entity was never revisited

2️⃣ Income Timing & Recognition Strategies

When income is taxed can be just as important as how much is taxed.

Strategic planning evaluates:

- Accelerating or deferring income

- Managing bonuses and distributions

- Smoothing income across years

- Avoiding unnecessary tax bracket spikes

Poor timing decisions often create avoidable tax bills and cash flow stress.

3️⃣ Expense & Capital Planning

Deductions are most powerful when they are timed correctly.

Strategic tax planning focuses on:

- Timing major purchases

- Depreciation and expensing strategies

- Matching deductions to high-income years

- Preventing deduction waste

The goal is not more deductions—it’s

maximum impact per dollar.

4️⃣ Compensation Strategy for Business Owners

Owner compensation is one of the most overlooked tax opportunities.

Strategic compensation planning balances:

- Reasonable salary compliance

- Payroll tax efficiency

- Distributions vs wages

- Retirement contribution strategies

This reduces unnecessary payroll tax while staying compliant.

5️⃣ Multi-Year & Exit-Focused Planning

True tax savings compound over time.

Multi-year planning allows business owners to:

- Model future income

- Anticipate tax law changes

- Plan exits years in advance

- Reduce taxes on sale or succession

This proactive approach is supported by IRS-compliant strategies outlined in

IRS guidance on business tax planning.

Why Reactive Tax Planning Is So Expensive

Reactive tax decisions often lead to:

- Excess self-employment tax

- Locked-in high tax brackets

- Missed retirement opportunities

- Reduced flexibility

- Increased audit risk

These costs rarely appear on a single return—but they compound every year.

Why Strategic Tax Planning Must Be Year-Round

The best tax strategies happen before:

- Income is earned

- Purchases are made

- Compensation is paid

- Transactions are finalized

Year-round planning allows:

- Mid-year adjustments

- Scenario modeling

- Predictable cash flow

- Better decision timing

This is why RC Jones & Associates works as a

strategic planning partner, not just a filing service.

Why Business Owners Trust RC Jones & Associates

RC Jones & Associates supports business owners who want clarity, control, and long-term results.

Their approach includes:

- Proactive planning meetings

- Entity and compensation reviews

- Multi-year tax modeling

- Missouri and federal coordination

- Clear, plain-English guidance

For individual and mixed-income earners, they also provide

Individual Tax Planning Support to ensure personal and business strategies align.

🚀Ready to Plan Smarter?

Your Strategic Tax Planning Starts Here

If you’re ready to move beyond compliance and reduce lifetime tax liability, strategic planning is the next step.

👉 Schedule Your Strategic Tax Planning Consultation with RC Jones & Associates today.

Quick Summary

Strategic tax planning helps business owners reduce lifetime tax liability by focusing on proactive, year-round decisions rather than reactive tax filing. Many business owners overpay because tax strategy is considered after income, purchases, and compensation decisions are already made. Unlike tax compliance, which only reports past activity, strategic planning structures future decisions to legally minimize taxes.

RC Jones & Associates uses a multi-year advisory approach built on five pillars: entity optimization, income timing, expense and capital planning, owner compensation strategy, and long-term exit planning. This process helps business owners improve cash flow, reduce payroll and self-employment taxes, and avoid unnecessary tax bracket increases. Strategic tax planning is especially valuable for high-income earners, S-corporation owners, and growing businesses seeking clarity, control, and long-term tax efficiency using IRS-compliant strategies.

FAQ SECTION

How is strategic tax planning different from tax preparation?

Strategic tax planning focuses on reducing future tax liability through proactive, multi-year decision-making, while tax preparation focuses on filing past activity.

Who benefits most from strategic tax planning?

Business owners, entrepreneurs, and high-income earners with growing or complex income structures benefit the most.

When should I start strategic tax planning?

Ideally before year-end or early in the year—always before major financial decisions are finalized.

Can strategic tax planning reduce lifetime tax liability?

Yes. Multi-year planning and proactive strategies can significantly reduce total taxes paid over time

Is strategic tax planning legal?

Yes. Strategic tax planning uses IRS-compliant methods to legally minimize tax exposure.