Reverse 1031 Exchanges: A Strategic Tax Planning Opportunity

Robert Jones • October 27, 2025

Introduction to Reverse 1031 Exchanges

What is a Reverse 1031 Exchange?

A reverse 1031 exchange is a powerful tax strategy that allows a property owner to acquire a replacement property before selling their currently held property, while still deferring capital gains taxes under IRS Section 1031.

Unlike a traditional 1031 exchange—which requires the relinquished property to be sold first—a reverse exchange reverses the sequence, offering greater flexibility when the perfect property becomes available before your sale is complete.

Ideal for Business Owners Who:

- Need to act fast on a prime commercial property

- Want to avoid taxable gain from selling their current location

- Are reinvesting in business property or rental real estate

Strategic Tax Benefits

Deferring Capital Gains Taxes

By structuring the transaction properly, a reverse exchange can help you defer capital gains taxes and depreciation recapture on the sale of a business-use or investment property.

Cash Flow Preservation

Avoiding an immediate tax bill allows you to reinvest more capital in your business or in acquiring better-positioned real estate.

Market Timing Advantage

With a reverse exchange, you can move quickly on an ideal property—particularly beneficial in competitive or appreciating markets.

Example Scenario

A small manufacturing business identifies a larger facility perfectly suited for expansion. Rather than waiting to sell their current property (and potentially missing out), they acquire the new building using a reverse 1031 exchange structure. After securing financing and acquiring the new space, they later sell their old location and defer all taxable gains—freeing up capital for improvements and equipment purchases.

How It Works

The Process, Simplified:

- Acquire the Replacement Property – The new property is purchased first, using a specially designated entity known as an Exchange Accommodation Titleholder (EAT).

- Hold Period Begins – The EAT temporarily holds legal title to the property.

- Sell the Relinquished Property – Within 180 days, you must sell your original property.

- Complete the Exchange – Once the original property sells, the exchange is finalized and tax deferral is secured.

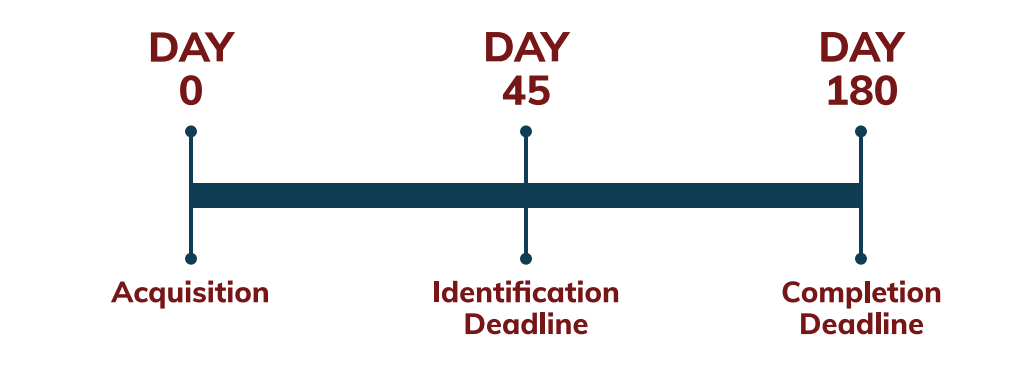

Timeframes Are Strict:

Just like traditional exchanges, reverse exchanges are subject to strict timing and identification rules. You must identify the relinquished property within 45 days of acquiring the replacement property and complete the sale within 180 days.

Common Challenges & Risks

Financing Complications

Lenders may be hesitant to finance a property that will be held temporarily by an EAT. Coordinating financing in a reverse exchange requires careful planning.

Legal & Administrative Complexity

Reverse exchanges are more complicated than traditional ones. They require legal agreements, escrow coordination, and IRS-compliant documentation.

High Upfront Costs

There are typically higher administrative costs for reverse exchanges. While these are often outweighed by tax savings, they must be factored into your planning.

Solution? Expert Guidance

Our team at RC Jones & Associates coordinates with your lender, legal counsel, and qualified intermediaries to ensure the process runs smoothly. Proper structuring is critical to preserve your tax benefits and avoid IRS scrutiny.

Why Proper Tax Planning Matters

Planning Makes the Difference

A reverse 1031 exchange isn’t something you want to “wing.” Proper planning ensures:

- You meet all IRS deadlines

- Your documentation is audit-proof

- You know exactly what’s deductible and what’s not

- You’re positioned to reinvest strategically

The RC Jones & Associates Approach

A We don’t just file paperwork. We help you:

- Evaluate whether a reverse 1031 is your best option

- Build a tax-optimized reinvestment plan

- Navigate the financing and legal hurdles

- Ensure IRS compliance at every step

FAQs About Reverse 1031 Exchanges

Can I live in the new property?

No. 1031 exchanges—reverse or otherwise—only apply to investment or business-use property, not primary residences.

What happens if I miss the 180-day deadline?

Unfortunately, the exchange fails and you may owe capital gains tax on the entire transaction. That’s why professional oversight is critical.

Is a reverse exchange allowed for personal property or vehicles?

No. Reverse exchanges are only available for real property used in a trade or business or held for investment.

Do I need to identify the replacement property in writing?

Yes. The IRS requires a formal identification process—even in a reverse exchange. It’s best to handle this with your exchange facilitator and tax advisor.

What if my relinquished property sells for less than expected?

That’s a risk. You should work with your advisor to stress-test different scenarios and determine your cash needs before entering a reverse exchange.

Let's Talk Strategy

Reverse 1031 exchanges are not one-size-fits-all. Your real estate decisions impact your taxes, your liquidity, and your business growth. At RC Jones & Associates, we believe that every dollar saved through smart planning is a dollar reinvested in your success.

Ready to explore whether a reverse 1031 exchange is right for you?